The Greatest Guide To Private Schools Debt Collection

The Of Business Debt Collection

Table of ContentsEverything about Dental Debt CollectionSome Known Facts About International Debt Collection.Private Schools Debt Collection Things To Know Before You Buy9 Simple Techniques For International Debt Collection

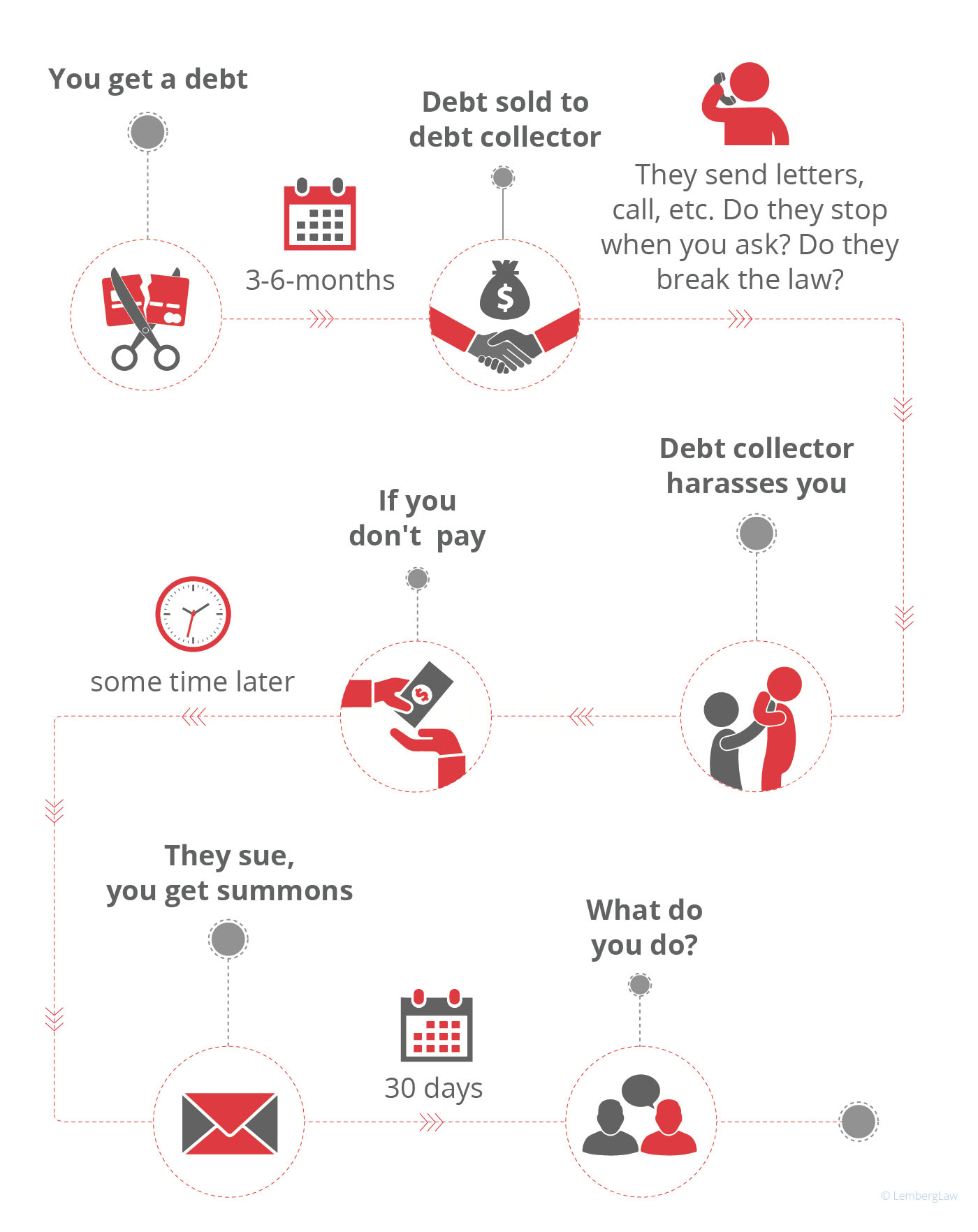

The debt buyer purchases just an electronic file of info, usually without sustaining proof of the financial obligation. The financial obligation is likewise typically older financial obligation, often described as "zombie financial debt" because the debt customer attempts to revitalize a financial obligation that was past the law of constraints for collections. Financial obligation debt collector may contact you either in composing or by phone.

Not chatting to them won't make the debt go away, as well as they might simply attempt alternative approaches to call you, including suing you. When a financial debt enthusiast calls you, it is necessary to get some first info from them, such as: The debt enthusiast's name, address, and telephone number. The total quantity of the debt they claim you owe, consisting of any fees and also interest costs that may have accumulated.

Personal Debt Collection Things To Know Before You Get This

The letter should state that it's from a financial debt enthusiast. Call as well as resolve of both the debt enthusiast and also the debtor. The financial institution or lenders to whom the debt is owed. A breakdown of the financial debt, consisting of costs and also interest. They must likewise notify you of your civil liberties in the financial debt collection procedure, as well as how you can dispute the financial obligation.

If you do challenge the debt within one month, they need to discontinue collection initiatives till they supply you with evidence that the financial debt is your own. They must give you with the name as well as address of the initial financial institution if you request that info within 1 month. The debt recognition notice must consist of a form that can be used to contact them if you wish to contest the financial debt.

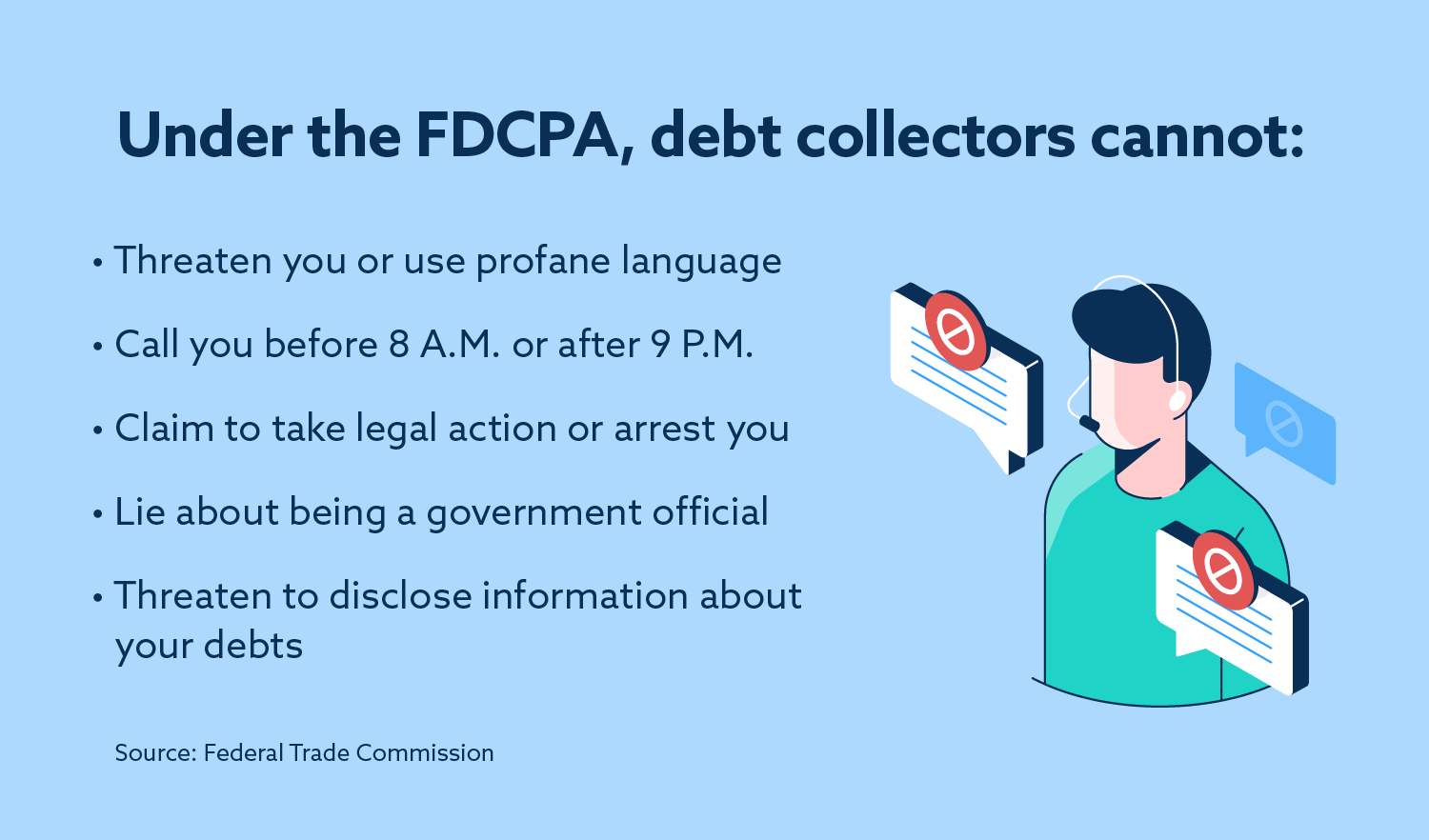

Some things debt collection agencies can not do are: Make repeated calls to a borrower, meaning to frustrate the debtor. Threaten physical violence. Use profanity. Lie about just how much you owe or claim to call from an official government workplace. Normally, debt is reported to the credit scores bureaus when it's thirty days overdue.

If your financial debt is moved to a debt collection agency or sold to a debt buyer, an access will certainly be made on your credit rating report. Each time your financial obligation is marketed, if it remains to go overdue, an additional access will certainly be included to your credit score record. Each negative entry on your credit rating report can stay there for up to 7 years, even after the financial debt has actually been paid.

Some Known Details About Personal Debt Collection

What should you expect from a collection company and how does the process job? Check out on to discover out. When you have actually made the decision to hire a debt collection agency, make certain you pick the best one. If you follow the advice below, you can be certain that you've employed a reliable firm that will handle your account with care.

As an example, some are much better at obtaining outcomes from bigger companies, while others are knowledgeable at collecting from home-based organizations. See to it you're dealing with a business that will really serve your demands. This might seem noticeable, yet before you employ a collection firm, you require to make certain that they are certified useful link and also accredited to function as financial obligation enthusiasts.

Before you begin your search, understand the licensing requirements for debt collector in your state. This way, when you are interviewing firms, you can speak intelligently regarding your state's requirements. Check with the companies you speak to to ensure they meet the licensing demands for your state, specifically if they are situated somewhere else.

You should also get in touch with your Better Company Bureau and the Business Debt Collector Organization for the names of reputable as well as very regarded financial obligation collection agencies. While you may be passing along these debts to a collector, they are still representing your company. You need to recognize just how they will represent you, how they will certainly function with you, as well as what relevant experience they have.

Some Known Questions About Business Debt Collection.

Even if a tactic is legal does not suggest that it's something you desire your business name connected with. A credible debt collector will function with you to outline a plan you can cope with, one that treats your previous consumers the means you would certainly desire to be treated and still does the job.

If that takes place, one strategy many firms utilize is skip tracing. You need to additionally dig right into the collection agency's experience. Appropriate experience raises the possibility that their collection initiatives will certainly be successful.

You ought to have a point of get in touch this hyperlink with that you can connect with and also get updates from. Business Debt Collection. They ought to have the ability to clearly articulate what will be gotten out of you at the same time, what info you'll need to give, as well as what the cadence and triggers for communication will certainly be. why not look here Your picked firm should have the ability to suit your chosen interaction requirements, not require you to approve their own

No matter of whether you win such a situation or not, you intend to make sure that your company is not the one on the hook. Request for evidence of insurance from any type of collection company to safeguard yourself. This is usually called an errors and also noninclusions insurance policy. Financial debt collection is a service, and it's not a low-cost one.